AIX sat down with Paul Colley, Chief Technology Officer at Spafax, a leading content service provider for the airline industry to learn how the company is redefining client-facing in-flight entertainment (IFE).

About Paul Colley, Spafax

Paul Colley has been instrumental in revolutionising Spafax’s delivery process in developing and launching innovative products like:

- Buzz

- Sprint

- Spafax IQ

- and, most recently, Lens

Based in London, Paul holds a degree in computer science from University College London and brings over 25 years of experience building and delivering software solutions that add value to businesses large and small.

“AIX is crucial for Spafax because it allows us to showcase our latest and greatest innovations.”

Paul Colley, Chief Technology Officer, Spafax

Spafax delivers content technology and media assets at scale for the world’s leading airlines and curates a vast catalogue of global movies, TV, audio and games across every major entertainment market.

Current clients include:

- Air Canada

- American Airlines

- British Airways

- Delta Air Lines

- Emirates

- the Lufthansa Group

- Mercedes-Benz

- Singapore Airlines and many others

Spafax provides brands unique access to a global network of a billion passengers across hundreds of touchpoints. The group is headquartered in London with over a dozen offices worldwide.

What will you be showcasing at AIX 2023?

“We’re excited to showcase Lens, Spafax’s new platform, providing a user-friendly global view portal for airline clients to manage curated in-flight entertainment content. It will launch shortly with two airline customers.

It’s important to note that this is a client-facing and not a passenger-facing solution – we designed Lens to give airlines a more engaging and visual approach to backend IFE content management than traditional methods like Excel grids.

“AIX is a way to stay ahead in a rapidly evolving aviation and interiors industry.”

Paul Colley, Chief Technology Officer, Spafax

It’s about giving our airline customers a crystal-clear view of their IFE content selection, making it easier to grasp their programming choices, and offering total transparency over content curation.”

What innovations or trends are you anticipating in the aviation and interiors industry this year?

“In response to the challenges posed by the global pandemic, the industry has been making significant strides in optimising supply chains. For example, Spafax has dedicated the past couple of years to enhancing our automation and cloud solutions, implementing artificial intelligence and machine-learning technologies. The goal has been to shorten content timelines and achieve cost savings for airlines, which has proven successful.

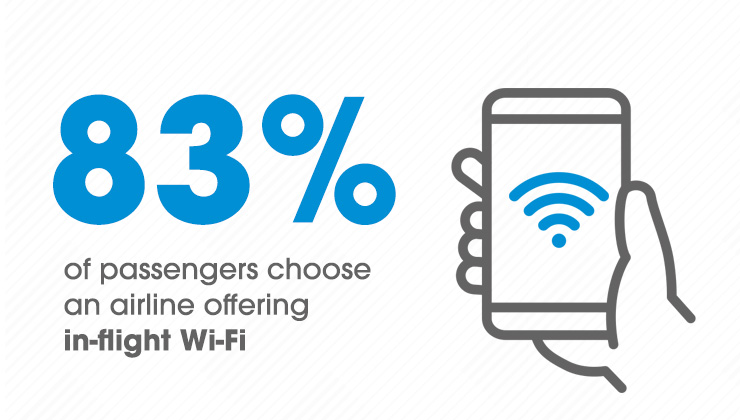

In the near future, we’re confident that IFEC systems will continue evolving into richer customer experience platforms. This will allow airlines to connect with their passengers more sophisticatedly, offering a better experience that can rival other entertainment platforms.

This will enable airlines to present their brand more immersively during flights and create a more memorable and engaging journey for passengers.

With this in mind, we’ll continue developing new services and products that elevate airlines’ onboard and on-ground experience. It’s essential that our solutions play a leading role in shaping the industry’s future and enhancing the overall travel experience for passengers.”

What are you looking forward to seeing/experiencing again at AIX, and why?

“AIX brings together the full spectrum of suppliers that deliver passenger-centric technology to airlines. It’s an opportunity to see some of our clients face-to-face, discover new ideas, share insights with industry leaders, and stay updated on trends. It also provides a platform to network and connect with key aviation and interiors sector players.”

Can you share any notable experiences or customers you’ve gained at AIX?

“Previous positive experiences drove our decision to return to AIX in the past, where the expo facilitated fruitful conversations, establishing notable partnerships and acquiring new customers.”

“This will enable airlines to […] create a more memorable and engaging journey for passengers.”

Paul Colley, Chief Technology Officer, Spafax

Why is exhibiting at AIX important for you and your company?

“Coming to Hamburg and exhibiting and attending AIX is crucial for Spafax because it allows us to showcase our latest and greatest innovations, such as our new Lens platform, to a global industry audience. It’s a chance to engage with potential clients and partners, demonstrate products and services and, ultimately, maintain a competitive edge in the industry.”

Would you recommend AIX to other companies? Please share why.

“Absolutely, it offers a platform to network, learn about the latest trends, and gain exposure to a global audience. Participating in AIX is a way to stay ahead in a rapidly evolving aviation and interiors industry environment and position your company for growth and success.”